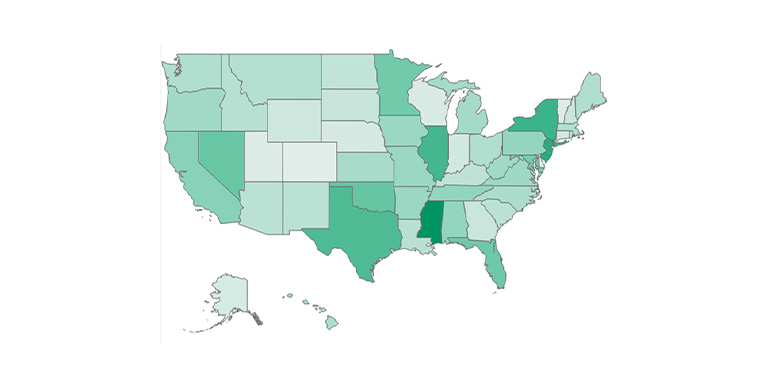

SHARE: With 39 of the 51 jurisdictions convening in January (Montana, Nevada, North Dakota, and Texas do not have a regular session in even-numbered years), NASBA has already been monitoring pre-filed legislation for 2022. In addition, 26 legislatures work within the framework of a two-year cycle, allowing them to carry over legislation. For example, 78 de-regulation bills monitored by NASBA filed in 2021 can potentially carry over to 2022 sessions. NASBA, along with ARPL partners, will be monitoring these and any new de-regulation bills filed in 2022, and assisting state partners to defeat or amend legislation as needed. To review legislation of interest to a Board of Accountancy, CLICK HERE. Once on the Legislative Tracking home page, using graphs and maps, plus descriptive text, the page clearly displays not only what issues are being raised in various states directly impacting State Boards of Accountancy, but also spotlights trends in legislation that other professions are encountering. Users can filter bills to focus on specific topics such as: deregulation, marijuana, digital currencies, and tax preparers. Key Person Contact NASBA’s Key Person Contact (KPC) program identifies Board of Accountancy members and executive directors who have personal and/or professional relationships with those serving in state and federal legislatures – along with those serving in the executive branches of state government. These individuals can provide additional backing for the support or opposition of legislation affecting the regulation of the accounting profession and produce a coherent and cohesive network. The KPC program serves as a nexus for transmitting information to legislators and reporting information about proposed or pending legislation to NASBA. Click here to learn more.

|