SHARE: Author: Jenna Elkins, Communications and Digital Media Specialist One of the very first questions a CPA Exam candidate may ask is, “What are the four CPA Exam sections?” The Uniform CPA Examination (CPA Exam) is comprised of four sections, each four hours long: Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR) and Regulation (REG). It is critical for all candidates to know what to expect for each section in order to do well on the CPA Exam. To give a brief overview of each section, we have pulled information straight from the AICPA CPA Exam Blueprints. Auditing and Attestation (AUD) The AUD section of the CPA Exam tests the knowledge and skills that a newly licensed CPA must demonstrate when performing:

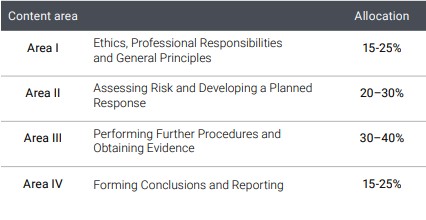

Newly licensed CPAs are also required to demonstrate knowledge and skills related to professional responsibilities, including ethics, independence and professional skepticism. Professional skepticism reflects an iterative process that includes a questioning mind and a critical assessment of audit evidence. It is essential to the practice of public accounting and the work of newly licensed CPAs. The following table summarizes the content areas and the allocation of content tested in the AUD section of the CPA Exam:  (graph from the AICPA CPA Exam Blueprints) Business Environment and Concepts (BEC) The BEC section of the CPA Exam tests knowledge and skills that a newly licensed CPA must demonstrate when performing:

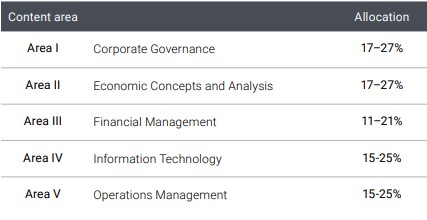

The content areas tested under the BEC section of the CPA Exam encompass five diverse subject areas. These content areas are corporate governance, economic concepts and analysis, financial management, information technology and operations management.  (graph from the AICPA CPA Exam Blueprints) Financial Accounting and Reporting (FAR) The FAR section of the CPA Exam assesses the knowledge and skills that a newly licensed CPA must demonstrate in the financial accounting and reporting frameworks used by business entities (public and nonpublic), not-for-profit entities and state and local government entities. The financial accounting and reporting frameworks that are eligible for assessment within the FAR section of the CPA Exam include the standards and regulations issued by the:

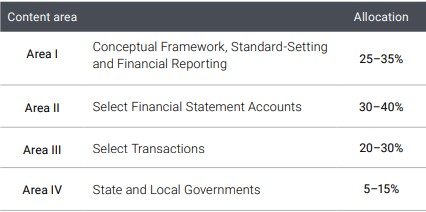

(graph from the AICPA CPA Exam Blueprints) Regulation (REG) The REG section of the CPA Exam tests the knowledge and skills that a newly licensed CPA must demonstrate with respect to:

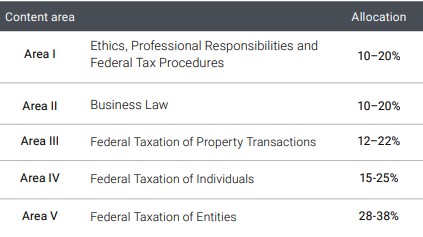

(graph from the AICPA CPA Exam Blueprints) Candidates who are looking for a more in-depth understanding of what information is on the CPA Exam, a review of the CPA Exam Blueprints is a must. This document is published one to two times per year and details the minimum level of knowledge and skills candidates must have to qualify for licensure. To understand the CPA Exam journey as a whole, the Candidate Guide is a great place to start. Best of luck to all candidates who are on they way to becoming a Certified Public Accountant! |