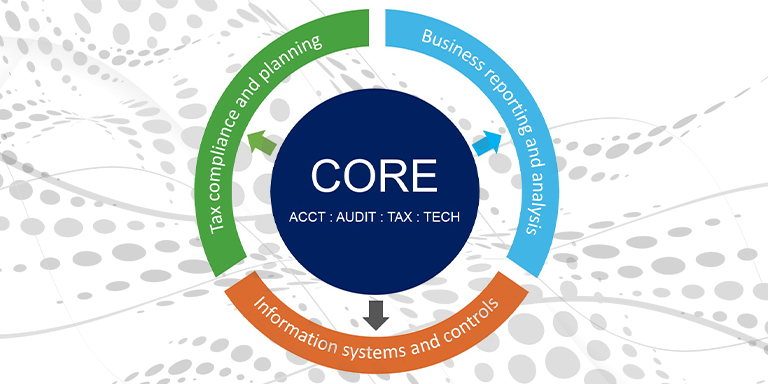

SHARE: Enhanced by NASBA’s Annual Meeting, the CPA Evolution initiative, a joint effort of the National Association of State Boards of Accountancy (NASBA) and the American Institute of Certified Public Accountants (AICPA), has been moving forward. The initiative aims to transform the CPA licensure model to recognize the rapidly changing skills and competencies the practice of accounting requires today and will continue to require in the future. Stakeholder Feedback Throughout the summer of 2019, NASBA and the AICPA employed a joint website, EvolutionOfCPA.org, to receive feedback from more than 2,000 stakeholders, including State Board of Accountancy members and executive directors, on a set of draft guiding principles. The number one comment received was support for the need to change licensure. Most respondents also supported a greater emphasis on technology skills and knowledge as a prerequisite for licensure. Respondents said CPA licensure should emphasize and be built around a strong core of accounting, auditing, tax and technology. NASBA and AICPA leadership carefully reviewed all of the feedback received, studied other professions’ licensure models and considered multiple options for an updated licensure model. NASBA and AICPA leadership then used this feedback and research to develop a new approach to licensure that is responsive to stakeholder input while still propelling the profession into the future. At NASBA’s Annual Meeting and at the AICPA’s Fall Council Meeting in October 2019, AICPA and NASBA leadership presented the feedback they heard from stakeholders and shared a draft model. The Draft Model The leadership of NASBA and the AICPA are recommending a “core + disciplines” licensure model. The model starts with a robust core in accounting, auditing, tax and technology that all candidates would have to complete. Then, each candidate would choose a discipline in which to demonstrate deeper skills and knowledge. Regardless of a candidate’s chosen discipline, this model leads to a full CPA license, with rights and privileges consistent with any other CPA. A discipline selected for testing would not mean the CPA is limited to that practice area. The proposed disciplines reflect three pillars of the CPA profession:

Future Plans Over the coming months, various stakeholder groups, including State Boards of Accountancy, state CPA societies, AICPA and NASBA volunteer committees and the academic community, will be engaged in filling in more details for the revised potential model. The two organizations aim to finalize an approach for revisions to the CPA licensure model by summer 2020. After the approach is finalized, the two organizations will establish implementation plans for what is expected to be a multi-year effort. In the coming months, NASBA will continue to share additional information about the initiative with the State Boards of Accountancy through the State Board Report, webinars and conferences. |