SHARE:

I was made aware of some promising news in the latest AICPA Trends Report: There has been an increase in the number of minority students enrolled in accounting classes. The increase is small but significant in that it indicates that minorities, particularly Hispanics, may recognize the potential opportunities associated with becoming a CPA. Upon reading this data, I was curious as to what the current trends and changes in U.S. demographics look like, and what their impact might be on the accounting profession. In my research, I came across a great article by James H. Johnson, Jr., Ph.D., entitled “Shifting Demographics and the Accounting Profession.” Some of you may remember Dr. Johnson from his highly regarded presentation at the 2015 NASBA Annual Meeting covering diversity and the role of State Boards. I was made aware of some promising news in the latest AICPA Trends Report: There has been an increase in the number of minority students enrolled in accounting classes. The increase is small but significant in that it indicates that minorities, particularly Hispanics, may recognize the potential opportunities associated with becoming a CPA. Upon reading this data, I was curious as to what the current trends and changes in U.S. demographics look like, and what their impact might be on the accounting profession. In my research, I came across a great article by James H. Johnson, Jr., Ph.D., entitled “Shifting Demographics and the Accounting Profession.” Some of you may remember Dr. Johnson from his highly regarded presentation at the 2015 NASBA Annual Meeting covering diversity and the role of State Boards.

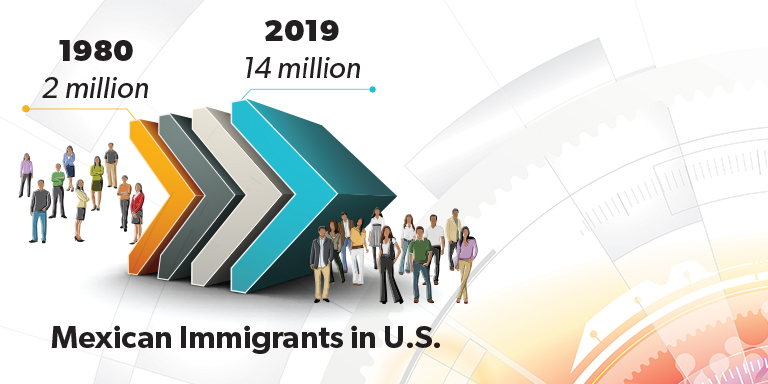

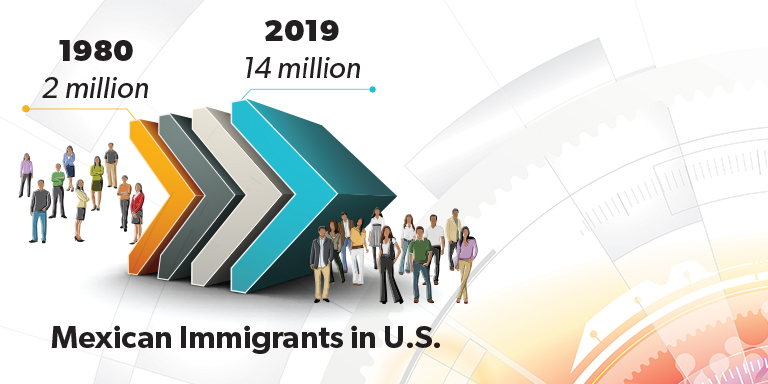

By far the largest group of recent immigrants to the United States are from Mexico. The best estimates of the number of Mexican immigrants living in the United States has increased from just over 2 million in 1980 to about 14 million today. The numbers are estimates because of the large number of Mexicans who have entered the country without documentation. What is more important to this discussion is the population growth by native births. According to Dr. Johnson’s research, the nativity increase for Hispanics between 2010 and 2017 was 18.4 percent (compared to the “white” nativity increase of 0.4 percent during that same period).

According to Dr. Johnson’s article, “In 2017, the U.S. population totaled 323 million, representing a 5.6 percent increase since 2010. Continuing a more than two-decade trend, a profound change in the race/ethnic composition of the population undergirded this growth.” What this means is people of color made up nearly all of the net growth of 16.7 million, a trend referred to as the “browning of America.”

The accounting profession has been slow to understand and react to the changes that are occurring. Despite the good news in my opening paragraph, that the number of minority students in accounting classes is increasing, thus far there is no evidence of a correlated increase in minority Uniform CPA Examination candidates. The profession of public accounting still remains primarily white.

Dr. Johnson discussed the implications for the accounting profession: “Failure to recognize and respond to these disruptive demographic trends could potentially create both recruitment and retention challenges for the accounting profession in the years ahead. To retain existing and recruit new diverse talent, accounting firms must re-evaluate their workforce recruitment and development strategies. They must also reassess how they manage talent and employee relationships within their firms.”

At NASBA’s 2019 Western Regional Meeting in June, Dr. Akinloye Akindayomi, a NASBA Accounting Education Research Grant recipient, told us about the study being done at the University of Texas – Rio Grande Valley School of Accountancy to identify the de-motivational factors inhibiting Hispanic students from participating in the Uniform CPA Examination (see sbr 7/19).

NASBA, on behalf of State Boards, has been increasing its focus on prioritization of diversity and changing demographics. In addition to our internal efforts to apply strategic policies of balanced demographics in our hiring and promotion of staff, we have also worked to ensure that NASBA’s leadership represents the diversity of our country. Externally we proudly sponsor The PhD Project in its efforts to attract minorities to become professors in business and accounting, and to support other accounting-related minority groups and organizations. All that we are doing is important, but the challenges are real.

One such challenge is highlighted in Dr. Johnson’s article: “Today, moreover many of these young people of color are concentrated in public school districts where there is inadequate financial support for their education, and they live in neighborhoods characterized by hyper-racial segregation and concentrated poverty. Owing to this ‘triple whammy’ of geographical disadvantages, most of these young people – an estimated 14 million – are at risk of falling through the cracks of the nation’s K-12 education system, reducing their odds of qualifying for admission to college and acquiring the requisite skills to compete in the unsparing global economy of the 21st century.”

Something I learned a long time ago is that to find solutions, you must recognize that you have a problem. Folks, we don’t have a problem − we have a challenge that requires solutions. The demographic composition of America is changing whether or not the accounting profession prepares for it. In the south, where I live, I have witnessed immigrants accomplishing the American dream by gaining skills, creating businesses and educating their children. The growing Hispanic-American population will increasingly need the professional services provided by CPAs and firms. When they enter your office, will they see someone who looks like them? Speaks their first language? Understands their culture? All things to think about!

Boards of Accountancy members are typically leaders in their communities, politically connected, and acclimated to problem solving. We just need to agree that there is a challenge, but also provide opportunities to meet our country’s changing demographics.

Semper ad meliora (Always toward better things).

— Ken L. Bishop

President & CEO

|