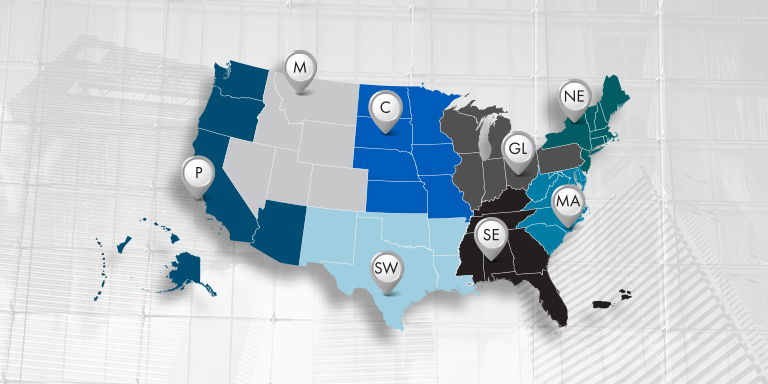

SHARE: All eight of NASBA’s Regions held conference calls in the last few weeks. Besides receiving updates on legislative efforts in and around their states, as presented by Vice President – State Board Relations Dan Dustin and Director of Governmental and Legislative Affairs John Johnson, the Board chairs and executive directors exchanged their insights on the top issues their Boards have been dealing with. The calls were moderated by the Regional Directors, who detailed the recent activities of the NASBA Board of Directors and answering questions about those efforts: Sheldon Holzman – Great Lakes Regional Call – January 30; Catherine Allen – Northeast Regional Call – February 5; Katrina Salazar – Pacific Regional Call – February 11; Andy Bonner – Southeast Regional Call – February 15; Jack Emmons – Southwest Regional Call – February 20; Faye Miller – Central Regional Call – February 20; Michael Womble – Middle Atlantic Regional Call – February 21; Nicola Neilon – Mountain Regional Call – February 25. Several Boards noted: antiregulatory legislation being proposed in their states; laws being introduced to allow convicted felons to receive licenses after a period of time; activity to bring their law into conformity with the Uniform Accountancy Act; delays in the appointments of Accountancy Board members; and additional review of the Boards’ activities either through sunset committees or other oversight bodies. Boards also discussed how their neighboring states and NASBA shared information for completion of required reports and addressing common regulatory issues. Among the more surprising reports was Texas is now awaiting the approval of its sunset legislation (SB 613) that would extend the Texas State Board of Accountancy for another 12 years, but would also require fingerprints from its licensees – even those who have been licensed for decades – and non-licensees who want to be owners of CPA firms. The legislation also requires that the Board include on the agenda of each regular Board meeting an opportunity for public comment on each agenda item before the Board makes a decision on it. Many Boards reported they support changing their rules or law to allow for continuous CPA Examination testing. They are looking forward to using the new CPE Audit Service program. NASBA’s communications department received many thanks for their assistance in enabling the Boards to provide their licensees with timely newsletters, e-mail blasts, videos and other information. Chief Communications Officer Thomas Kenny told the Boards about a swearing–in ceremony video that NASBA has produced which may encourage Boards to hold similar events. Among the issues mentioned on the regional calls were:

|