The More Things Change, the More They Stay the Same: Addressing the CPA Pipeline Crisis

Over the past several weeks, much has been written and spoken about the CPA pipeline crisis, including creative suggestions for possible solutions. There are certainly some sound ideas being offered for discussion, and as a partner in a public accounting firm and as a regulator, I welcome them all. At this point in time, the accounting profession needs all of its great minds to focus on this issue.

The demand for the services the skilled accountant can provide is at an all-time high, while the population of skilled accountants has remained flat. Baby boomer CPAs are retiring, or nearing it, with the number of young potential licensees entering the profession not keeping pace. This dilemma is not in fact new, but rather a confluence of circumstances years in the making and stemming from declines in

- U.S. birthrates

- Overall college and university enrollment

- The number of accounting graduates

- The number of CPA Examination candidates

The most recent “culprit,” cited by some, for the pipeline crisis is the 150-credit hour requirement required for licensure, which has been the law in most states and jurisdictions since the year 2000. This educational requirement is one of the cornerstones of substantial equivalency recognition and CPA mobility to practice across jurisdictional boundaries without necessitating additional licensure.

As someone who was involved in the debate and development of this requirement in my jurisdiction all the way back in 1990, I thought it might be useful to share some thoughts on the 150-credit hour education requirement. Despite these discussions occurring more than 30 years ago, I still have much of the information our Montana Society of CPA’s Task Force used then in our research on the issue. Maybe I had a sense that this was a significant turning point in the profession, when all involved knew the profession needed to “up its game” to attract once again the best and brightest.

Whatever the reason, as I dusted off my archived materials, I came across a 1989 study commissioned by the Big Eight accounting firms entitled, “Perspectives on Education: Capabilities for Success in the Accounting Profession.” As the report’s title implies, the study’s focus was to assess the current environment in the accounting profession and re-examine the educational process. The circumstances that existed in 1989 which prompted the study, and which were responsible for the subsequent drive to increase the educational requirements from 120 to 150 hours were cited as being:

- “The profession is changing, expanding and, as a result, becoming increasingly complex.”

- “Declining enrollments in accounting programs indicate that the profession is becoming less attractive to students.”

- “Today’s business world is more dynamic and complex than ever before.”

- “Advancing technology, proliferating regulations, globalization of commerce and complex transactions make the environment in which public accountants practice extremely challenging.”

- “Many accounting programs have experienced declines in enrollments, and questions are being raised regarding the quality of accounting graduates.”

- The supply and demand imbalance is a very real problem for the profession.”

Does any of this sound familiar as we discuss today’s pipeline challenges? As the saying goes, the more things change, the more they stay the same.

The study’s conclusion at that time, of course, was that there was a need to increase the educational requirements, stating education for the accounting profession must produce graduates who have acquired a broad array of skills and knowledge, are focused on communication skills (formal and informal, written and verbal), possess strong intellectual skills (creative problem-solving in a consultative process), and bring interpersonal acumen to their professional work (e.g. management skills and leadership competencies). The study emphasized that passing the CPA examination should not be the goal of accounting education, rather the focus of education should be on developing analytical and conceptual thinking.

Back in 1990, many of us believed this to be true, resulting in the increase in the education credit hour requirement from 120 to150.

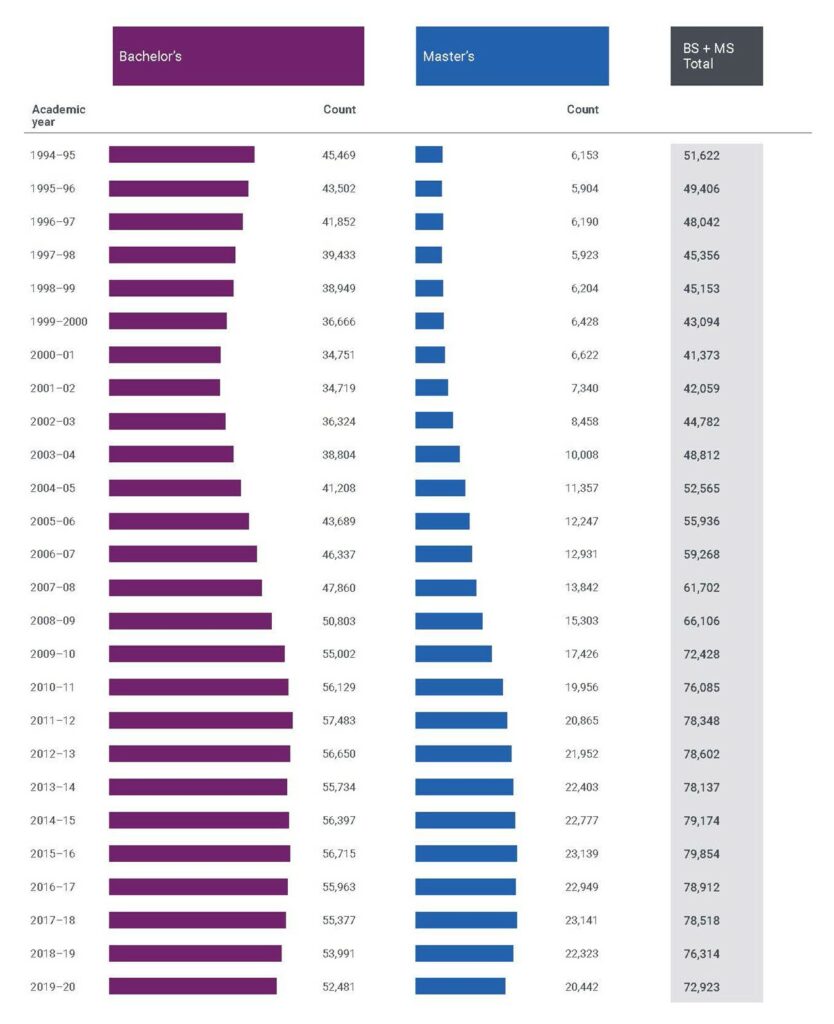

Since the 150-credit hour requirement became effective in most jurisdictions in the year 2000, these have been the trends in accounting degree completions:

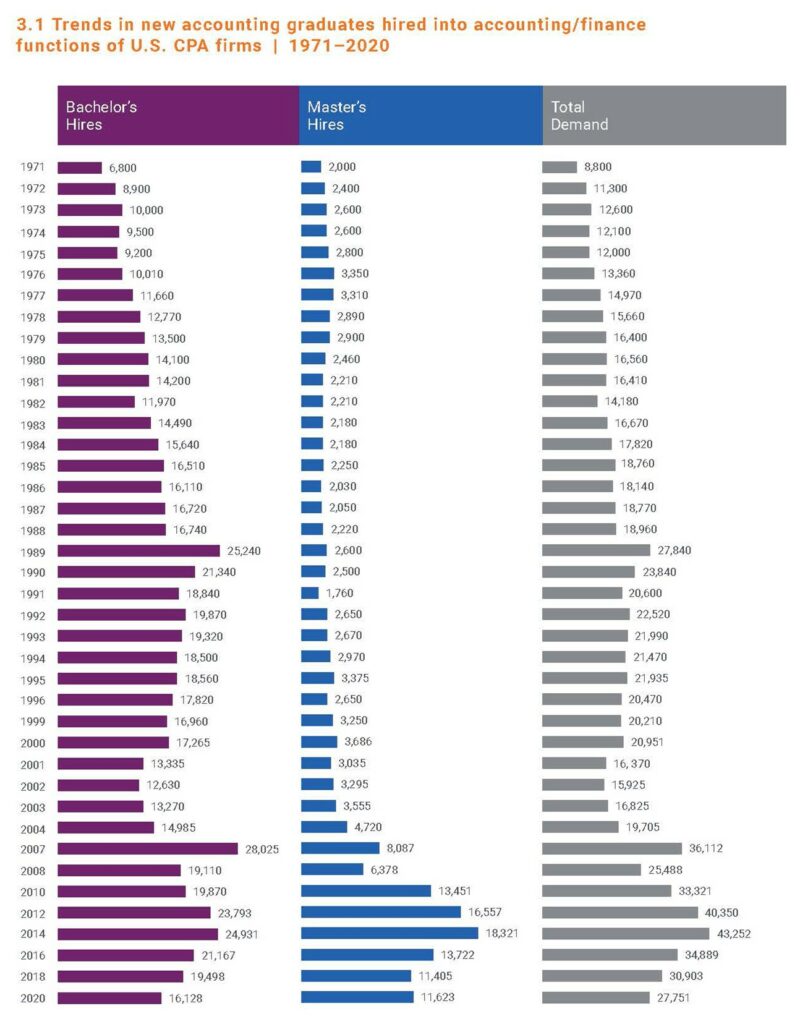

The trends in accounting graduates hired into accounting/finance functions of U.S. CPA firms have been as follows:

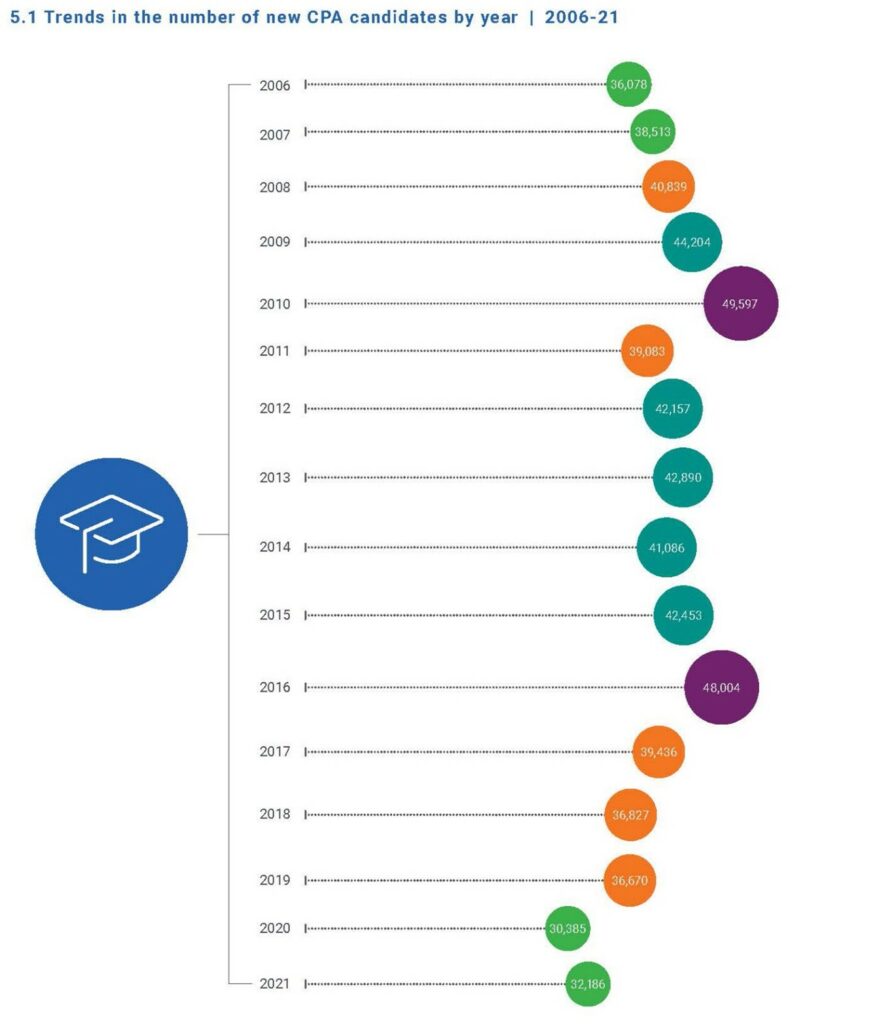

And the trends in the number of new CPA candidates have been as follows:

There is no question numbers in all categories have trended downward over the past seven years, after the record highs enjoyed in 2016. But targeting the 150-credit hour requirement as the key contributor for the decline is not supported by the numbers above, nor by the responses of most accounting students when asked about their perception of the challenges they face in entering the profession.

The CPA Evolution Initiative, launched prior to the Covid pandemic, is based on the transformation of the profession to meet the growing and changing needs of the marketplace, as well as the changing desires of those we need to attract to the profession. Those best and brightest whom we hope to attract back to our profession will not come back because we’ve made entry easier by reducing educational requirements, reducing the rigor of the CPA exam, or lowering the experience requirement.

Rather, CPA Evolution is predicated on attracting the best and brightest to the accounting profession by re-establishing and enhancing the career opportunities available to them. Until 2016, students joined this profession because of those opportunities. Admittedly, the profession has been slow to adapt and keep up with the rapidly changing marketplace, making accounting less desirable. CPA Evolution is the joint NASBA/AICPA effort to combat and correct that dilemma.

The concept of substantial equivalency recognition and CPA licensure mobility was hard-fought, yet worth the effort, as it sets the accounting profession apart from many other professions across the globe. We need to protect mobility at all costs. The uniform educational requirement “works” to protect CPA licensure mobility because the quality of education provided can be relied upon across jurisdictional boundaries due to consistent accreditation standards. Professional experience used as a replacement for education would not work the same way, as there is no “accrediting body” attesting to the sufficiency and/or quality of experience provided.

Yes, like me, many of us obtained a CPA license prior to the 150-credit hour education requirement, and we’re doing “just fine.” We need to acknowledge that we expect much more from our staff when they come to us — particularly during their first year with the firm—than we ever did before. If there were ever a time we need our young staff to come to us with more education not less, it’s now. That’s what CPA Evolution is all about–providing the education and the skillsets not needed yesterday, or even today, but those that will be needed for tomorrow! How can relying on the experience earned “yesterday” be an effective replacement for the education necessary to prepare our staff for what will be needed tomorrow?

Many suggestions currently being offered by accounting groups and/or firms aim to address our immediate need. Certainly, credit goes to all who are attempting to do something. However, pipeline enhancement efforts that neglect to consider substantial equivalency and CPA licensure mobility will ultimately do more harm to the profession than good, when measured over the long-term.

The AICPA and State CPA Societies, along with NASBA and State Boards of Accountancy, have been working together to come up with both short-term and long-term solutions to address the pipeline crisis, and have been in discussion with various stakeholder groups seeking feedback. The most recent Uniform Accountancy Act exposure draft is just one of the solutions proposed. Only working together will we be able to appropriately address the issue without causing any long-term negative effects. Working independently would at best, delay and at worst endanger CPA licensure mobility.

Rick Reisig, CPA

Principal

pinionglobal.com