Legislative Updates: Don’t Assume – Constantly Educate and Reinforce!

SHARE:

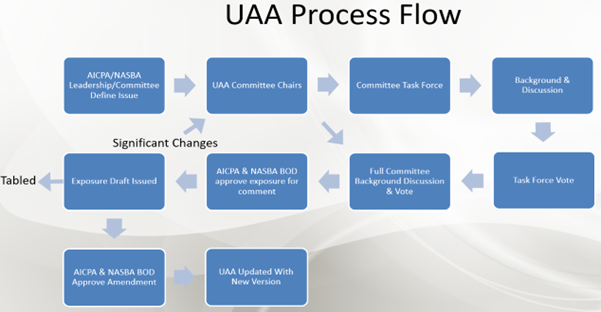

The desirability of uniformity among accountancy jurisdictions is recognized in the Uniform Accountancy Act (UAA), which has created and refined systems to provide for: mobility, peer review, continuing professional education requirements, non-CPA ownership, CPE Reciprocity and the ease for reciprocal licensure in almost all 50 states, territories, and the District of Columbia—all while protecting the health, safety, and welfare of the public.

This system is built upon a statutory foundation providing for the examination and licensure of members of the profession, the regulation of their professional conduct, and predicated upon jurisdictions adopting substantially equivalent requirements as set forth in the UAA in each of the 55 jurisdictions.

The main objective of the UAA is to advance the goal of uniformity, protect the public interest, and promote high professional standards—something that the accounting profession has been successful in achieving over the last two decades, and something for which all stakeholders have cause to feel pride. The UAA effectively blends both public protection and the ability for professionals to practice and move freely among jurisdictions.

Unfortunately, that vital blend is at risk in this climate of deregulation, where some policymakers are focused on the “least restrictive means” to protect the health, safety, and welfare of the public. In a race to the bottom, much of what the accounting profession has achieved could be lost if just one ill-advised and one-size-fits-all policy takes root in one jurisdiction.

Therefore, it is worth every accountancy board’s time to first: Never assume policymakers in your jurisdiction know about the well-engineered UAA as well has how it is updated. In particular, how most jurisdictions have adopted many of the provisions within the UAA—substantial equivalency, non-CPA ownership, mobility, CPE reciprocity, to name a few—and therefore, provide a rather “borderless” map by which professionals can move and practice. And second: In educating policymakers, boards can illustrate the intended, and possibly unintended, consequences of what could happen to uniformity if these blanket pieces of legislation take root. The protection and freedom of the UAA advance could be undone, putting their constituents at risk—both the constituents who practice accountancy and those constituents who rely on them. Don’t Assume – constantly educate and reinforce!

Please contact John Johnson, Director of Legislative and Governmental Affairs, at [email protected] if you have questions or need additional information.