NASBA and AICPA Propose Draft “Core + Discipline” CPA Licensure Model Designed to Future-Proof the Profession

SHARE:

DURHAM, NC and NASHVILLE, TN (December 10, 2019) – The National Association of State Boards of Accountancy (NASBA) and the American Institute of CPAs (AICPA) have proposed a new CPA licensure model that is designed to evolve newly licensed CPAs’ knowledge and skills, protect the public interest and position the CPA profession for the future. NASBA and AICPA believe this draft model will address the greatly expanding body of knowledge required of newly licensed CPAs, which includes a deeper understanding of systems, controls, SOC engagements and data analysis.

The proposed model reflects dialogue with stakeholders such as AICPA members, firms of all sizes, academia, federal regulators, students, technology experts, state CPA societies and state boards of accountancy on five guiding principles to inform the creation of a new licensure model. Feedback on the principles from more than 2,000 stakeholders indicated these themes:

- There is support for the need to change the CPA licensure model to have a bigger emphasis on technology skills and knowledge in licensure. The majority of stakeholders shared this view.

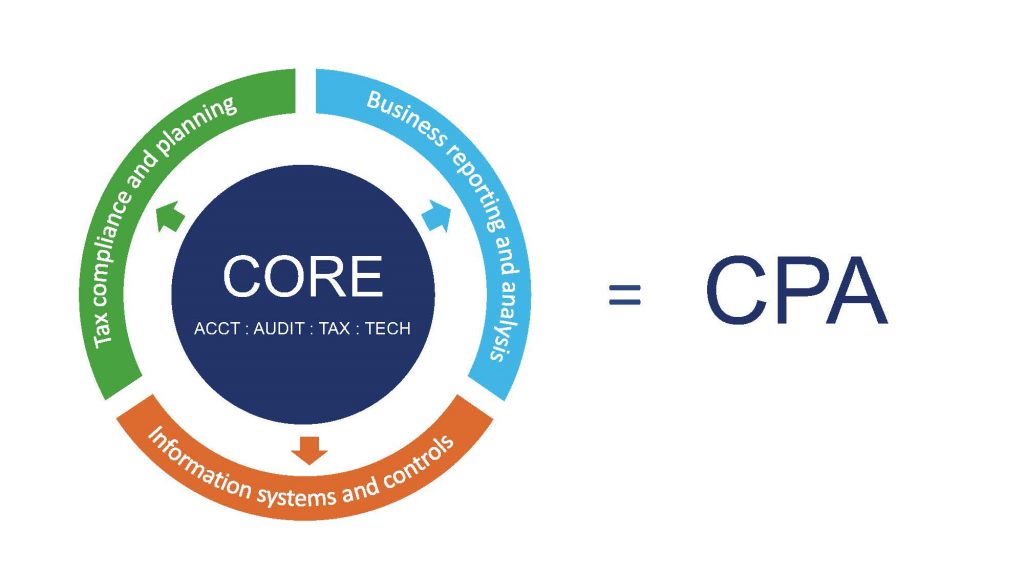

- All newly licensed CPAs should demonstrate strong common core competencies of accounting, auditing, tax and technology.

- While technological expertise should be required for licensure, there are other factors disrupting the profession, and a revised licensure model should be about maintaining the strength and relevance of the CPA license to ensure continued public protection.

NASBA and AICPA also conducted a study of other professions’ licensure models. The organizations aim to finalize an approach for a new licensure model by Summer 2020, followed by a multi-year implementation plan. Both organizations are still collecting feedback on the proposed model and those wishing to provide input may email [email protected].

The draft model’s robust requirements start with a strong core in accounting, auditing, tax and technology that all candidates would be required to complete. Then, each candidate would choose a discipline in which to demonstrate deeper skills and knowledge. Regardless of chosen discipline, this proposed model would lead to a full CPA license, with rights and privileges consistent with today’s CPA. A discipline selected for testing would not mean the CPA is limited to that practice area. (See attached image of the possible model.)

“U.S. Boards of Accountancy, as regulators, must remain relevant to protect the public we serve,” claimed NASBA Chair Laurie Tish, CPA. “Today’s marketplace is shifting and CPAs need new skills to continue to serve organizations and the public. We need to ensure that CPAs continue to have the competencies needed to support an accounting profession that plays a critical role in protecting the public interest,” she added.

The proposed model will:

- Enhance public protection by producing candidates who have the deep knowledge necessary to perform high-quality work, meeting the needs of organizations, firms and the public;

- Reflect the realities of practice by requiring candidates to demonstrate deeper proven knowledge in one of three disciplines that are pillars of the profession;

- Be adaptive and flexible, helping to future-proof the CPA as the profession continues to evolve; and

- Result in one CPA license.

“The model we are proposing reflects the realities of practice today. When you look at the profession twenty or thirty years ago, it’s evident that the demands of CPAs have grown,” said Bill Reeb, CPA, CITP, CGMA, chair of the AICPA. “For example, today there are three times as many pages in the Internal Revenue Code, four times as many accounting standards and five times as many auditing standards as there were in 1980. As our body of knowledge has expanded, we’ve stretched the exam and curriculum to cover more and more material, but that approach isn’t sustainable. We need a licensure model that is flexible enough to evolve with our profession.”

More information on the CPA Evolution initiative may be found at www.evolutionofcpa.org.

See the Full Media Announcement:

NASBA and AICPA Propose Draft “Core + Discipline” CPA Licensure Model Designed to Future-Proof the Profession